Save to Buy

Save to buy

If you're looking to buy your first home, but you're short on the deposit, take a look at our unique Save to Buy scheme.

It could be your answer for stepping onto the property ladder and doing it in style - in one of our brand new, energy-efficient homes.

Make your home buying dreams a reality in 2025.

How it works

Save to Buy is a scheme designed to help those who otherwise could not afford to buy.

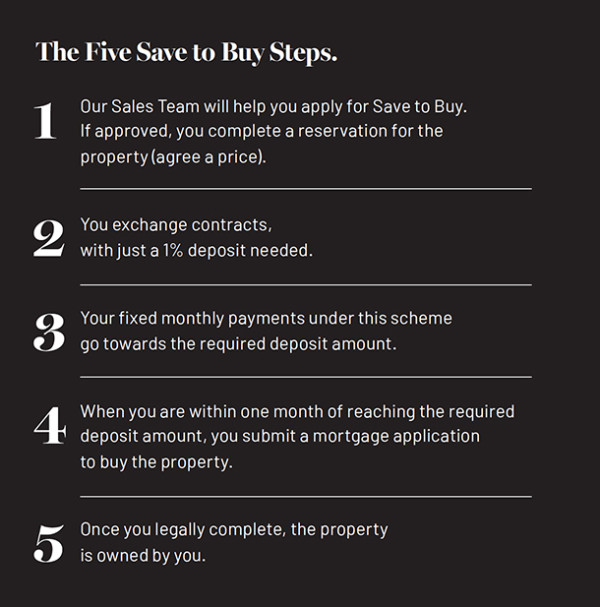

The scheme is available on selected plots and subject to status. You can apply for the Save to Buy scheme with a Sales Representative on developments where there is availability. If approved for the scheme, you will complete a reservation form and exchange contracts with just a 1% deposit.

You will move in, and live in your brand new, energy-efficient home at a fixed monthly cost. 100% of the amount you pay through the Save to Buy scheme goes towards topping up your deposit - so you aren't wasting a single penny on rent.

When you are within one month of reaching your required deposit amount, you will submit a mortgage application form to buy the property.

-

Register Interest

Save to buy

Register below for our Save to Buy scheme and a Sales Representative will be in contact to let you know next steps.

Please note to be eligible for this scheme you must have

- a 1% deposit

- be a UK resident or have lived in the UK for over two years

- be in full time employment

Frequently asked questions

Save to Buy is designed to help those who otherwise cannot buy immediately. If this is you, speak to a Sales Representative.

Each Save to Buy agreement will be different, as the amount is based on your personal finances and the average local monthly rent. During occupation, you will also pay the normal costs associated with owning your home. We will help guide you on what costs to budget for.

On average 6 to 12 months, but it may be available for up to 2 years if needed.

Yes. If you can, we recommend you do this to bring your home ownership forward and there are ways in which we can help you.

You will need to be advised by a recommended financial advisor. They will outline what deposit and income may be required to progress. They will request related documents and undertake a credit check to verify your eligibility.

If your circumstances change, please speak to your sales advisor as all situations will be treated individually so we can assist you in working towards home ownership.

Save to Buy is offered on a first come, first served basis and is subject to availability of selected plots. If there are no Save to Buy designated plots available, the scheme will not be open for applications.

Yes. Our new-build homes are covered by a 10-year warranty.

Register your interest on the form above and a Sales Representative will be in contact to book your appointment at the relevant Fairview New Homes development.

Save to Buy Testimonials

The Green at Epping Gate

Loughton

-

No of bedrooms

1-3

-

Price

TBC

-

Est. completion date

Available now

A collection of spacious and stylish studio, 1 & 2 bedroom apartments and 2 & 3 bedroom duplexes, designed with modern life in mind. Perfectly located close to beautiful Epping Forest, yet within easy reach of the bustle of town, The Green offers you a truly superb place to call home. Here, you are within the desirable ‘Golden Triangle’ of Loughton, Buckhurst Hill and Chigwell, where high street stores, luxury boutiques and chic restaurants make everyday life a real pleasure. You are also close to excellent transport links and local amenities.

Dock28

London, London

-

No of bedrooms

1-3

-

Price

TBC

-

Est. completion date

October - August 2025

Dock28 is an exciting development comprising 216 studio, one, two and three bedroom apartments and three bedroom duplexes, located in the Royal Borough of Greenwich. These stylish new homes occupy a prime location just a 4 minute walk to the River Thames in the historic naval and military town of Woolwich, named one of the "Best Places To Live" in 2023 by The Sunday Times, with fantastic transport connections on your doorstep. All homes now sold.