Save to Buy - Deposit

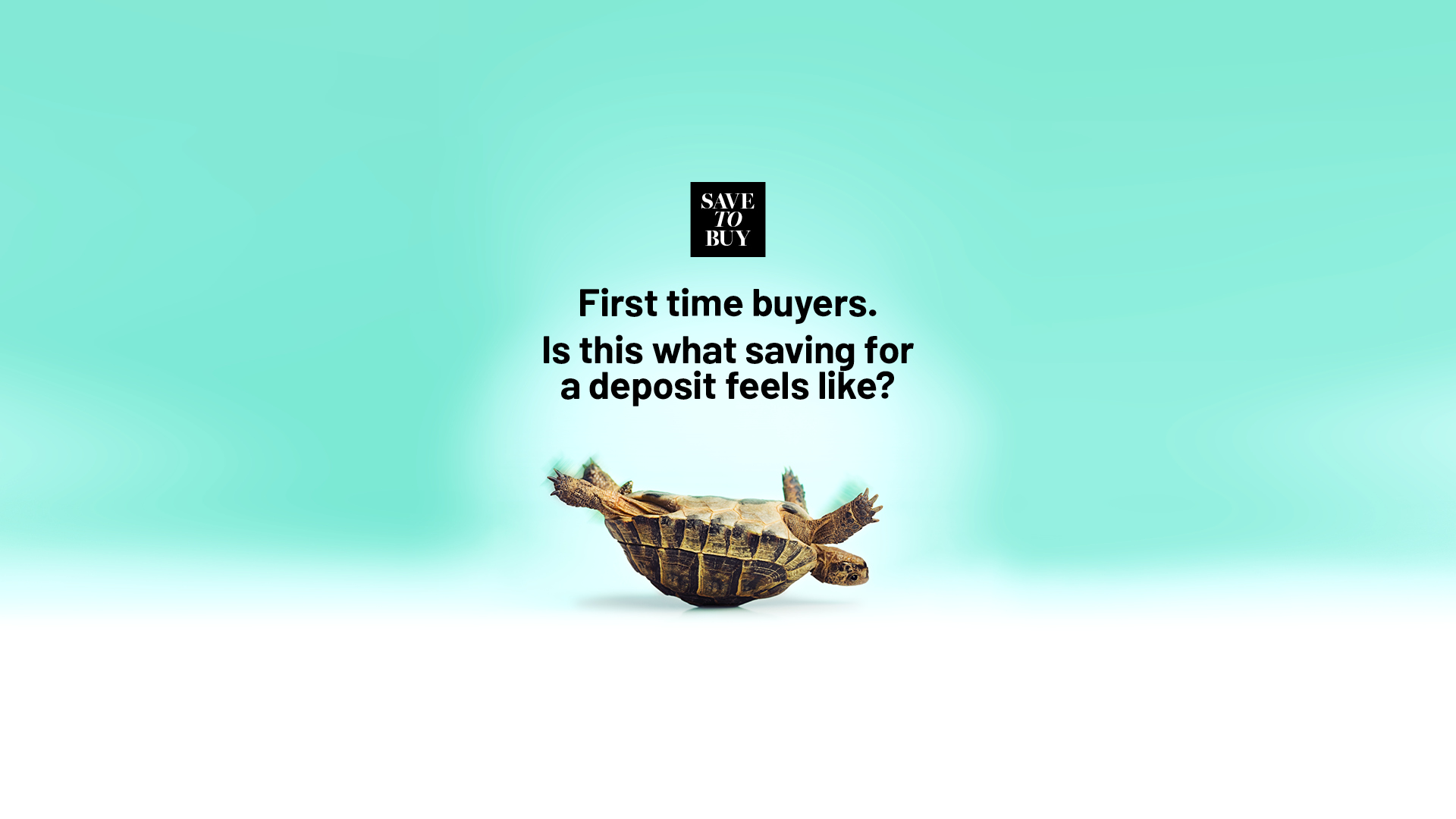

Thank you for letting us know the position you're in with your deposit.

You are not currently eligible for the Save to Buy scheme but we would love to find out how we can help you.

Please bear with us while we make our way through all of the enquiries, we will be in touch in due course.

Frequently asked questions

Save to Buy is designed to help those who otherwise cannot buy immediately. If this is you, speak to a Sales Representative.

Each Save to Buy agreement will be different, as the amount is based on your personal finances and the average local monthly rent. During occupation, you will also pay the normal costs associated with owning your home. We will help guide you on what costs to budget for.

On average 6 to 12 months, but it may be available for up to 2 years if needed.

Yes. If you can, we recommend you do this to bring your home ownership forward and there are ways in which we can help you.

You will need to be advised by a recommended financial advisor. They will outline what deposit and income may be required to progress. They will request related documents and undertake a credit check to verify your eligibility.

If your circumstances change, please speak to your sales advisor as all situations will be treated individually so we can assist you in working towards home ownership.

Save to Buy is offered on a first come, first served basis and is subject to availability of selected plots. If there are no Save to Buy designated plots available, the scheme will not be open for applications. The scheme will finish in December 2023.

Yes. Our new-build homes are covered by a 10-year warranty.

Register your interest on the form above and a Sales Representative will be in contact to book your appointment at the relevant Fairview New Homes development.